What 344 Billion Lines of COBOL Code Mean for the Future of Banking Tech

A Language That Refuses to Die

COBOL has been declared dead more times than most languages have been deployed. Yet in 2025, it still powers the core operations of global finance—including payment processing, loan origination, account reconciliation, and tax reporting.

Why? Because it works.

COBOL systems are stable, time-tested, and deeply embedded in the workflows of nearly every major bank, credit union, and government financial agency. They process trillions of dollars daily and handle transactions for millions of customers without fail.

This isn’t nostalgia—it’s inertia. For decades, COBOL was the most efficient way to codify business rules into reliable, batch-driven systems. The result is a language that became less a tool and more a substrate: the invisible layer under every ATM, wire transfer, and retirement account.

And while other languages rise and fall with tech trends, COBOL has endured precisely because of its deep entanglement with business logic. It’s not just code—it’s policy, regulation, and institutional memory, frozen in syntax.

But endurance comes at a cost. As COBOL systems age, and the people who understand them retire, banks are facing an uncomfortable truth: the language may not die, but the ability to support it is fading fast.

That’s where the next section takes us—into the scale problem that turns this technical debt into a systemic risk.

The Scale Problem: 344 Billion Lines and Counting

COBOL’s staying power isn’t just a story of resilience—it’s a story of volume. Today, there are an estimated 344 billion lines of COBOL code still in active use, with the majority running in financial institutions around the world.

This scale presents a uniquely modern problem: how do you understand, maintain, and modernize something so vast that no one person—or even team—fully grasps its scope?

These billions of lines span:

- Core banking systems for deposits, payments, and lending

- Credit card platforms and fraud detection routines

- Customer master records and KYC compliance checks

- Tax, treasury, and regulatory reporting logic

- Interfaces to ATMs, SWIFT networks, and mainframe schedulers

The complexity isn’t just in the quantity of code—it’s in the interconnectivity. Many programs call others in deeply nested chains. Business logic is often scattered across dozens of copybooks and embedded conditions. Documentation is sparse or missing entirely.

This code isn’t siloed. It’s active. It processes live transactions every second. Which means even reading it is risky. Changing it—without full impact analysis—can result in cascading failures across services, from payments to regulatory disclosures.

And it’s not going away soon. According to industry forecasts:

- Over 90% of in-person banking transactions still touch COBOL

- Many core systems process billions of dollars daily

- Some banks maintain 100+ million lines of COBOL code in production

The challenge is no longer just modernization—it’s mass comprehension. Not “how do we replace it?” but “how do we understand it well enough to evolve it safely?”

Talent, Risk, and the Retirement Cliff

For decades, COBOL was the language of business computing. It was taught in universities, mandated by mainframe vendors, and widely adopted by government and financial institutions. But today, the engineers who built these systems are retiring—and taking decades of institutional knowledge with them.

This has created what many banks now refer to as the retirement cliff: a sharp decline in available COBOL expertise with no clear replacement pipeline.

Consider the reality:

- Most experienced COBOL developers are in their 60s or 70s

- Very few universities teach COBOL today

- Most new engineers prefer modern languages and cloud-native tooling

- Internal knowledge is rarely documented in a way that others can access

The result is a talent bottleneck—and a risk multiplier. When a critical transaction process fails or needs updating, there may be only one person in the organization who truly understands how it works. And if that person isn’t available, the system stays frozen.

This creates both operational risk and strategic inertia:

- Maintenance takes longer, costs more, and introduces greater risk of regression

- Modernization initiatives slow down due to lack of insight or confidence

- Compliance deadlines become harder to meet because no one can trace logic back to source

And while some banks have tried to outsource the problem or retrain engineers, neither approach scales easily. Training COBOL from scratch takes years. Outsourcing may shift the work—but not the accountability or institutional understanding.

Without a way to extract, preserve, and scale COBOL knowledge, the retirement cliff becomes a systemic vulnerability.

The solution isn’t to eliminate COBOL overnight. It’s to build systems—human and machine—that can interpret it, document it, and make it navigable.

Modernization in Motion: Why ‘Rip and Replace’ Won’t Work

For many CIOs, the instinct is clear: if COBOL is aging, and the talent pool is shrinking, then the solution must be to rebuild the system entirely in a modern language or cloud platform.

But for large financial institutions, a full “rip and replace” approach is not just risky—it’s often impossible.

Why? Because COBOL isn’t a single system. It’s a network of interdependent programs that touch nearly every business process, often in ways that aren’t fully documented. Removing or rewriting one part can trigger failures in others—especially when the logic spans decades of business rule evolution.

Banks that attempt full rewrites often encounter:

- Cost overruns from underestimated complexity

- Project fatigue after multi-year timelines with limited ROI

- Functional regression when rewritten code doesn’t replicate obscure logic

- Resistance from regulators who require full traceability and testing parity

- Loss of institutional knowledge that was never captured before decommissioning the legacy system

Even when rebuilds succeed, they often deliver partial functionality, requiring the legacy system to remain in parallel—defeating the goal of simplification.

Instead, successful organizations are shifting toward progressive modernization:

- Using APIs to wrap and expose legacy functions

- Replatforming select workloads while retaining COBOL core logic

- Refactoring high-change modules and surrounding others with microservices

- Applying AI to generate documentation and support safe modular extraction

This model preserves operational continuity while gradually moving toward modern architectures.

COBOL is not a wall to break through. It’s a foundation to build from—with surgical precision, not brute force.

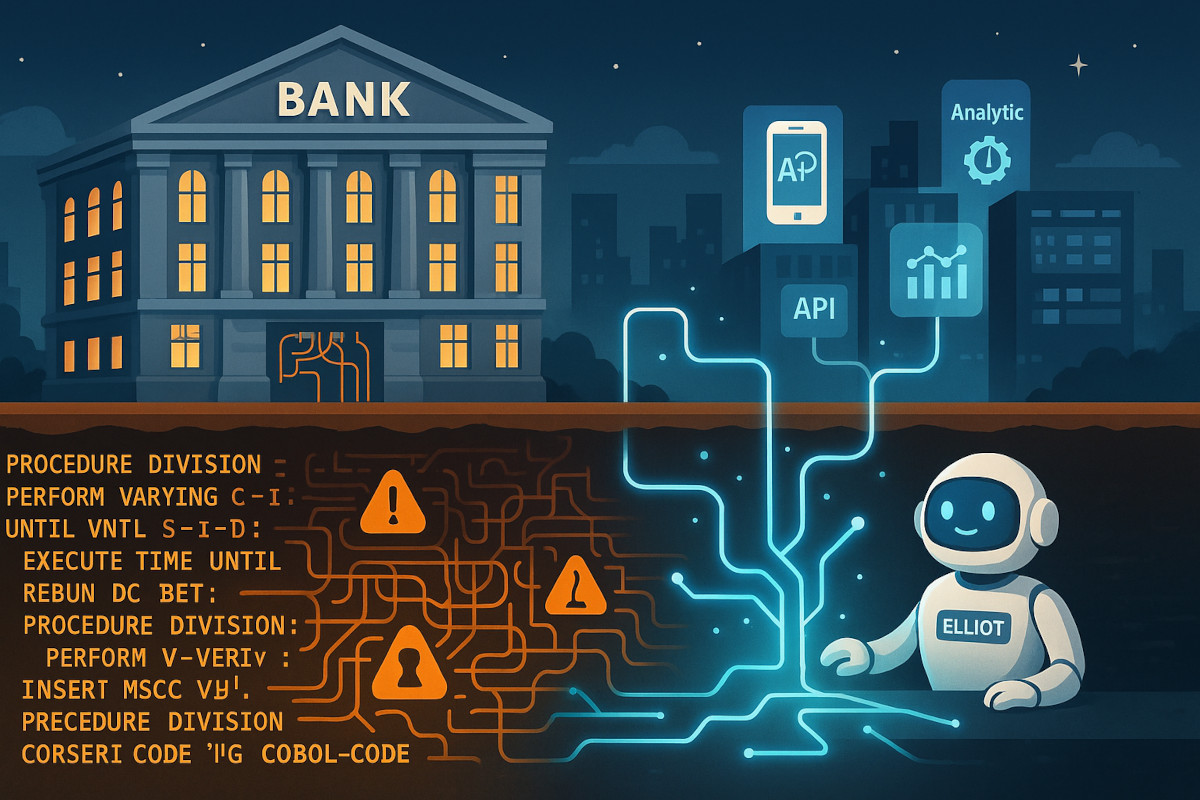

How AI Is Changing the Game for COBOL Systems

Modernizing COBOL systems used to mean months of reverse engineering, dependency mapping, and SME interviews. It was slow, error-prone, and entirely human-dependent.

AI is changing that—by making COBOL understandable at scale.

Platforms like Elliot are redefining what’s possible by applying AI-driven analysis to COBOL codebases, delivering insights that used to require decades of expertise.

Here’s how AI is transforming COBOL modernization:

1. Automated Code Comprehension

Elliot parses COBOL, JCL, and related mainframe artifacts to produce plain-English summaries of program logic, data transformations, and decision flows—turning opaque code into readable knowledge.

2. System-Wide Dependency Mapping

AI tools can analyze how thousands of COBOL programs interact, revealing call hierarchies, data lineage, and module dependencies—critical for impact analysis and safe refactoring.

3. On-Demand Business Logic Discovery

Teams can ask natural language questions like “Where is overdraft interest calculated?” and receive answers tied to specific source files and functions. This reduces SME dependency and accelerates onboarding.

4. Compliance and Audit Traceability

AI-powered documentation can show not just what code does, but why—tracing business logic back to regulatory requirements or functional specs. This is essential for audit readiness and change justification.

5. Modular Decomposition and Refactor Targeting

AI helps identify which parts of the codebase are stable and low-risk, and which are change-prone and good candidates for refactor or rebuild—enabling phased modernization.

With AI, COBOL isn’t just something to endure. It becomes navigable, documented, and measurably improvable—even across codebases with tens of millions of lines.

From Core to Composable: The New Architecture of Banking

Banks aren’t waiting for COBOL to disappear. Instead, they’re embracing a composable architecture approach—modernizing around the legacy core by building flexible, interoperable layers that support agility and innovation without forcing a total rebuild.

This strategy recognizes a fundamental truth: COBOL systems still work, but they’re not designed for today’s expectations of real-time access, API connectivity, or customer-centric services.

Composable banking addresses that by creating a new operating model:

1. Wrapping the Core with APIs

Instead of rewriting core logic, banks are exposing it through secure, governed APIs. This allows modern applications—mobile apps, digital onboarding tools, fintech integrations—to interact with legacy functions without altering the underlying COBOL.

2. Isolating Business Domains

By using domain-driven design, banks isolate discrete capabilities (e.g., payments, account services, fraud detection) from the monolith and refactor them as independent services—modernized gradually and in context.

3. Data Virtualization and Real-Time Access

Composable architectures allow data to be abstracted from the legacy core, enabling real-time queries and analytics without re-engineering every COBOL file.

4. Layered Innovation

Teams can innovate at the experience layer—building new apps and customer touchpoints—while gradually modernizing the back-end systems that power them.

5. Hybrid Cloud Enablement

Composable approaches integrate legacy systems into hybrid cloud environments where workloads can move between mainframes and cloud-native services depending on cost, latency, and compliance needs.

This model isn’t about elimination—it’s about evolution with control. It buys time, reduces risk, and gives banks a modernization runway that supports real-world constraints.

COBOL becomes part of the stack—not the blocker to progress.

What Banking CIOs Need to Do Now

For CIOs leading technology in financial institutions, the question isn’t whether to modernize COBOL—it’s how to do it intelligently, incrementally, and without breaking the business.

Here are five urgent actions CIOs should take now:

1. Build an Accurate Inventory of COBOL Assets

Most banks underestimate the size and complexity of their COBOL estate. Use AI-powered tools to audit the entire legacy stack, map dependencies, and create a dynamic inventory of programs, data flows, and interfaces.

2. Identify High-Risk and High-Change Areas

Focus first on modules with frequent change, high regulatory visibility, or customer-facing impact. These are often the best candidates for documentation, refactoring, or API exposure.

3. Create a Talent Continuity Plan

Identify your remaining COBOL SMEs and develop a knowledge transfer strategy. Pair them with modern engineers and use AI assistants like Elliot to document critical logic before that knowledge disappears.

4. Adopt a Composable Modernization Framework

Shift from one-time projects to continuous evolution. Invest in API layers, domain-driven decomposition, and hybrid infrastructure that lets you modernize incrementally—without halting operations.

5. Anchor Every Modernization Effort to Business Value

Every modernization sprint should tie back to a clear business outcome: faster onboarding, reduced regulatory risk, lower maintenance costs, or improved developer productivity. Make value delivery visible and measurable.

Modernization isn’t just a technical journey—it’s an organizational shift. CIOs must lead that transformation by combining legacy fluency with a strategic, forward-looking architecture.

And most critically, they must act. Because the systems still work—for now—but the risks are growing fast.

344 Billion Reasons to Modernize with Precision

COBOL isn’t a relic. It’s a living, breathing foundation of global banking infrastructure—still executing the rules, calculations, and transactions that keep money moving and institutions stable.

But 344 billion lines of code isn’t just a technical artifact. It’s a strategic liability when left undocumented, unsupported, and untouched for too long.

Banks that succeed in the coming decade won’t be the ones that eliminate COBOL overnight. They’ll be the ones that make it visible, governable, and adaptable—treating legacy not as dead weight, but as deep business logic in need of new interfaces and support.

That means:

- Replacing guesswork with intelligent system discovery

- Replacing bottlenecks with AI-powered knowledge access

- Replacing fear-driven rewrites with phased, composable evolution

This isn’t just modernization. It’s a shift in posture—from defensive maintenance to strategic stewardship of the systems that matter most.

The 344 billion lines of COBOL still running today are not a reason to panic. They’re a call to action. A signal that the future of banking tech depends not on what we abandon—but on how well we understand and evolve what we already have.

With the right visibility, tools, and mindset, banks don’t have to choose between legacy stability and modern innovation. They can have both.

Let’s Talk About Your COBOL Documentation and Modernization Needs — Schedule a session with CodeAura today.